Insurance coverage strategies are a balancing act in between deductibles and premiums. The more you want to pay monthly on your premium, generally the lower your deductible. Household picture by means of Wikimedia Commons High-deductible plans High-deductible health insurance, likewise described as "consumer-directed" strategies, are plans whose deductibles exceed a limitation set by the IRS.

For the insurance provider, a greater deductible methods you are accountable for a greater amount of your initial healthcare costs, conserving them cash. For you, the advantage can be found in lower month-to-month premiums. If you have a high-deductible plan, you are qualified for a Health Savings Account (HSA). These accounts allow you to set aside a minimal quantity of pre-tax dollars for medical expenditures.

Typically, your HSA is linked to a debit card that you can use on out-of-pocket costs, including that high deductible. Since the money in your HSA isn't taxed like the rest of your earnings, it serves a double purpose: assisting you reserved money to cover health care costs and decreasing your tax problem.

Satisfying a high deductible can seem overwhelming in the face of pricey medical bills. High-deductible strategies make sense for people who are generally healthy, and for those without children. Since preventive care is complimentary under the Affordable Care Act, and lots of policies enable you to see your primary care physician with a copay rather than paying toward the deductible, a couple of sees to the medical professional annually timeshare exit strategy will not be a financial problem for an otherwise healthy person.

However you'll pay a much greater premium for these strategies. Though specifics differ by area and plan details, a low-deductible plan can cost a minimum of two times as much each month as a high-deductible strategy. Strategies with lower deductibles and greater premiums are suggested for individuals who expect a significant quantity of treatment - how does whole life insurance work.

Likewise, households with children can gain from a low-deductible plan, especially if the kids are associated with sports or frequently ill. My suggestions to you Without knowing your earnings and regular monthly costs, it's tough to recommend a plan outright. While you mentioned your family is reasonably healthy, you are thinking about including a new relative.

How To Get Health Insurance Without A Job Fundamentals Explained

The following pointers should help you get a cost-efficient and thorough prepare for your household. Depending on your earnings, you might certify for help on your month-to-month premiums or cost-sharing costs. Make certain you explore these prospective discount rates before crossing out a strategy due to cost. maybe one low-deductible and one high-deductible health insurance.

gov reveals a household of your size in Texas might pay around $620 each month on a bronze-level PPO with a high deductible of $12,700. At the other severe, a gold-level PPO with a low deductible of $1,500 for the entire family comes at a premium of nearly $1,400 monthly.

By setting a maximum regular monthly spending plan for your premium, you can narrow the initial swimming pool of alternatives down considerably. A few important notes on estimating future medical expenses: Preventive care, including your children's annual examinations and immunizations and regular prenatal care check outs for your spouse, come at no charge to you under the Affordable Care Act - how much does health insurance cost per month.

Budget for an emergency clinic go to or more if your children are active in sports or otherwise accident-prone. If you do have another child, labor, shipment and hospitalization will likely comprise an excellent portion of your costs, as even an uncomplicated vaginal birth results in an average of $30,000 in medical facility charges.

When you add up all of the awaited expenditures, including your regular monthly premium, one strategy will likely stand apart as costing you less over the course of the year. However do not stop there. Deductibles are only one consideration among lots of when looking for health insurance coverage. Network size, out-of-pocket optimums, plan structure and covered expenses likewise are essential to consider.

If you're comparing a high-deductible strategy with a low-deductible strategy, your decision might boil down to what you value more: saving cash on premiums if you're fortunate adequate to prevent medical expenses, or feeling ensured that you don't need to fulfill a deductible when costs emerge. This part of the choice is mostly individual, however crunching numbers ahead of time will make the choice simpler.

The How Much Does Life Insurance Cost Diaries

Trying to identify your yearly healthcare costs? There are numerous pieces of the expense puzzle you must take into account, including your premiums, deductible, coinsurance and copay. Below is an explanation of each and examples that show how individuals utilize them to pay for health care. For information on your plan's out-of-pocket expenses and the services covered, check the Summary of Advantages and Protection, which is consisted of in your registration materials.

Higher premiums usually suggest lower deductibles. An example of how it works: Trisha, 57, plans on devoting herself to her three grandchildren after she retires. Understanding she'll need to keep up her energy, she simply signed up for a various healthcare plan at work. The plan premium, or expense of protection, will be taken out of her incomes.

That's important given that Trisha assured her grown children she 'd be more persistent about her own health. Find out more about how health plans with higher premiums typically have lower deductibles. Her new strategy will keep out-of-pocket costs foreseeable and manageable due to the fact that as a former cigarette smoker with breathing problems, she needs to see physicians and professionals routinely.

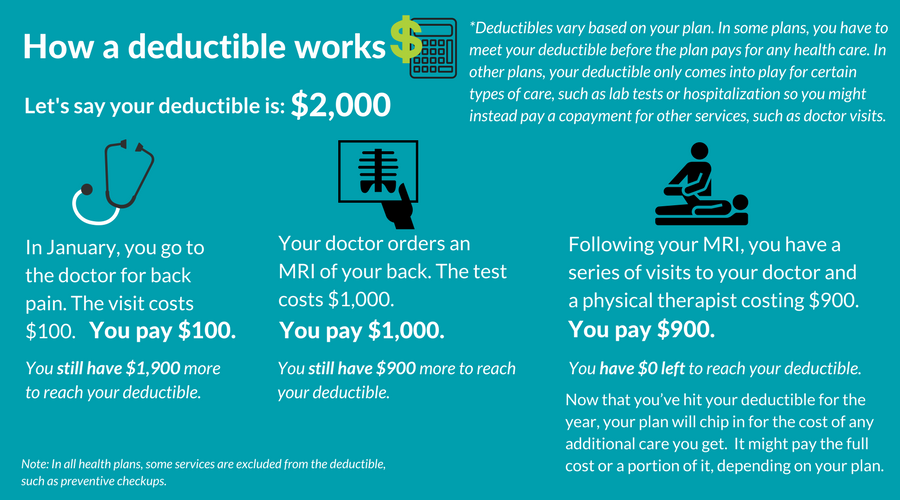

In the meantime, she's saving cash, listening to her doctors and delighting in time with her household on weekends. What is a deductible? A deductible is the amount you pay out-of-pocket for covered services before your health strategy begins. An example of how it works: Courtney, 43, is a single lawyer who just bought her first house, a condo in Midtown Atlanta.

When she felt a swelling in her breast during a self-exam, she right away had it had a look at. Have a peek at this website Fortunately, physicians told her it was benign, but she'll require to undergo a lumpectomy to have it eliminated. Courtney will pay out of pocket for the procedure until she fulfills her $1,500 deductible, the amount she pays for covered services prior to her health strategy contributes.

In the event she has more medical expenditures this year, it's good to understand she'll max out the deductible right away so she will not have to pay full price. Find out how you can save cash with a health cost savings account. https://ameblo.jp/lukaszdmb164/entry-12658180569.html What is coinsurance? Coinsurance is the percentage of the expense you pay after you fulfill your deductible.

What Does How Long Can You Stay On Parents Insurance Mean?

Their 3-year-old just recently fell at the playground and broke his arm. The household maxed out their deductible currently, so Ben will be responsible for just a portion of the costs or the coinsurance billed for the procedure to reset and cast the break. With his 20 percent coinsurance, he'll wind up paying a couple of hundred dollars for the hospital see.

Discover how healthcare facility plans can assist you cover expenses before you satisfy your medical deductible. What is copay? Copays are flat fees for certain gos to. An example of how it works: Leon, 34, is a married forklift operator from Jacksonville, FL. He's a devoted runner, but lately has had bothersome knee pain and swelling.